Intercultural challenges in a cross-border M&A

In today’s global environment, mergers and acquisitions (M&As) are becoming increasingly common. Companies are crossing national borders to expand and find themselves not only in foreign countries…but also facing intercultural challenges!

Combining two different companies isn’t necessarily a successful formula. Studies show that almost 83% of all mergers are doomed to fail*. The source of these failures? In 30% of the cases it’s the cultural gap in corporate cultures**.

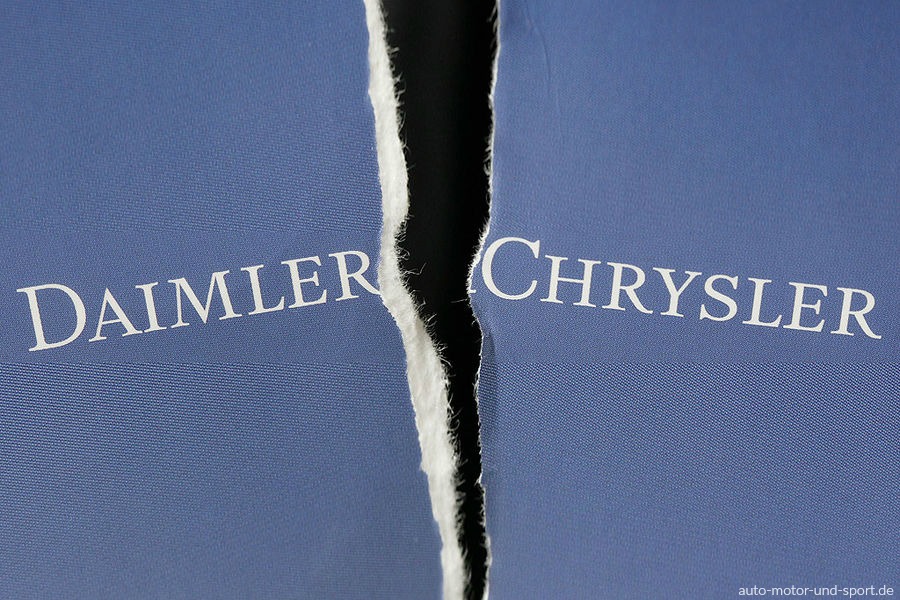

Daimler and Chrysler

Especially in cross-cultural situations, when the companies involved are from two different countries with their own organisational structures, difficulties in M&As are easily encountered. The example of Daimler-Chrysler in 1998 gives us clear insights into the issues caused by culture.

Daimler and Chrysler were two incredibly different companies. Daimler was a German company which could be described as “conservative, efficient and safe”, while Chrysler was known as “daring, diverse and creating”***. As a truly German company, Daimler had a hierarchical structure with a clear chain of command and a culture of respect for authority. Whereas Chrysler, their American partner, subscribed to a more egalitarian approach with a culture of risk taking and audacity. To make a long story short, the two organisations had completely different cultures, both organisational and national.

During the merger there was very little concern for the cultural differences between the companies and the Daimler-Chrysler merger ended in complete failure. Share prices plummeted and employees refused to work together. After 8 years of struggling, Daimler saw no other solution than selling Chrysler at a considerable loss.

Acknowledge the differences

When doing business abroad, it is immediately apparent that culture profoundly influences how people think, communicate, and behave. In the context of mergers and acquisitions, cultural differences can even lead to confusion, aggression and also distrust between the employees and the management of merging organizations. So how should you cope with these cultural differences in your M&A? By acknowledging the differences in (national) corporate cultures, you have already increased your chances of a successful merger. Start from the bottom and facilitate communication across groups and divisions to build a synergized culture and turn that M&A into a success!

Do you need any advice on your merger & acquisition, or related topics? Contact n.ripmeester@labourmobility.com and explore the possibilities! Or book one of our International Team Coaching sessions.

Babet Agten,

ELM team

*KPMG, 2000: 10

**SHRM, 2005: 1

***Appelbaum, Roberts and Shapiro, 2009:44.

© Expertise in Labour Mobility B.V. All rights reserved.